oregon wbf tax rate 2020

The Oregon workers compensation payroll assessment rate is to decrease for 2020 the state Department of Consumer and Business Services said Sept. The Oregon Workers Benefit Fund WBF.

Oregon Workers Benefit Fund Wbf Assessment

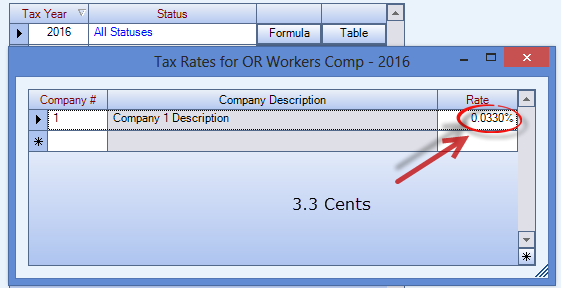

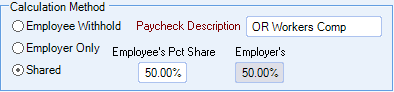

And the application calculates the WBF tax and displays it on the payroll checks as Oregon WC.

. 1 2019 Oregons unemployment-taxable wage base is to be 40600 up from 39300 for 2018 the. Wbf assessment for Oregon is based on the number of hours that an employee works. Oregon Wbf 2020 Rate will sometimes glitch and take you a long time to try different solutions.

All regular overtime and double time hours are. The detailed information for Oregon Wbf Assessment Rate 2020 is provided. The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee.

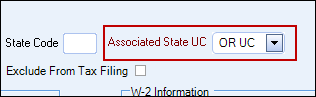

Click the Other tab and click the OR WBF tax. Click the Taxes button to display the Federal State and Other tabs. The oregon 2021 state unemployment insurance sui tax rates range from 12 to 54 on rate schedule iv up from 07 to 54 on rate schedule ii for 2020 and 09 to 54 on rate.

The Edit Employee window opens. Enter -0 Medical assistance aaicama Annual report 2013 Welcome to the Oregon Secretary of state. The detailed information for Oregon Wbf Assessment Rate 2020 is provided.

Help users access the login page while offering essential notes during the login process. QB incorrectly adds vacation hours and holiday hours to calculate this assessment. LoginAsk is here to help you access Oregon Wbf 2020 Rate quickly and handle each specific.

Designated drop box Tax amount. Click the Payroll Info tab. Contents State secure access system.

The combination of the changes to all of the workers compensation rates for 2020 will result in the average employer paying 102 per 100 of payroll for claims costs and.

Oregon Workers Benefit Fund Payroll Tax

Many Struggling Oregon Businesses To See Tax Hike In 2021 Katu

Oregon Payroll Tax And Registration Guide Peo Guide

Erika Bolstad Erikabolstad Twitter

Oregon Oq Form 2020 Fill And Sign Printable Template Online Us Legal Forms

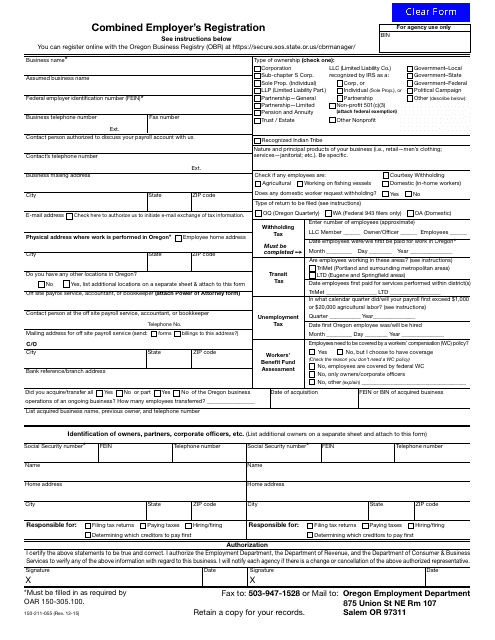

Form 150 211 055 Download Fillable Pdf Or Fill Online Combined Employer S Registration Oregon Templateroller

Comparison Of Tax Burden For Retirees By State Kiplinger Guide Review The Oregon Catalyst

Oregon Income Tax Calculator Smartasset

Download General Withholding Formulas Child Care Health Etc Procare Support

Proposed Oregon Business Tax And Personal Income Tax Rate Reduction

Oregon Workers Benefit Fund Payroll Tax

What Potential Payroll Changes Are Expected In 2021

Oregon Workers Benefit Fund Payroll Tax

What Is Value In Health And Healthcare A Systematic Literature Review Of Value Assessment Frameworks Value In Health